DUO SPLIT

Budget. Couple. Simplicity.

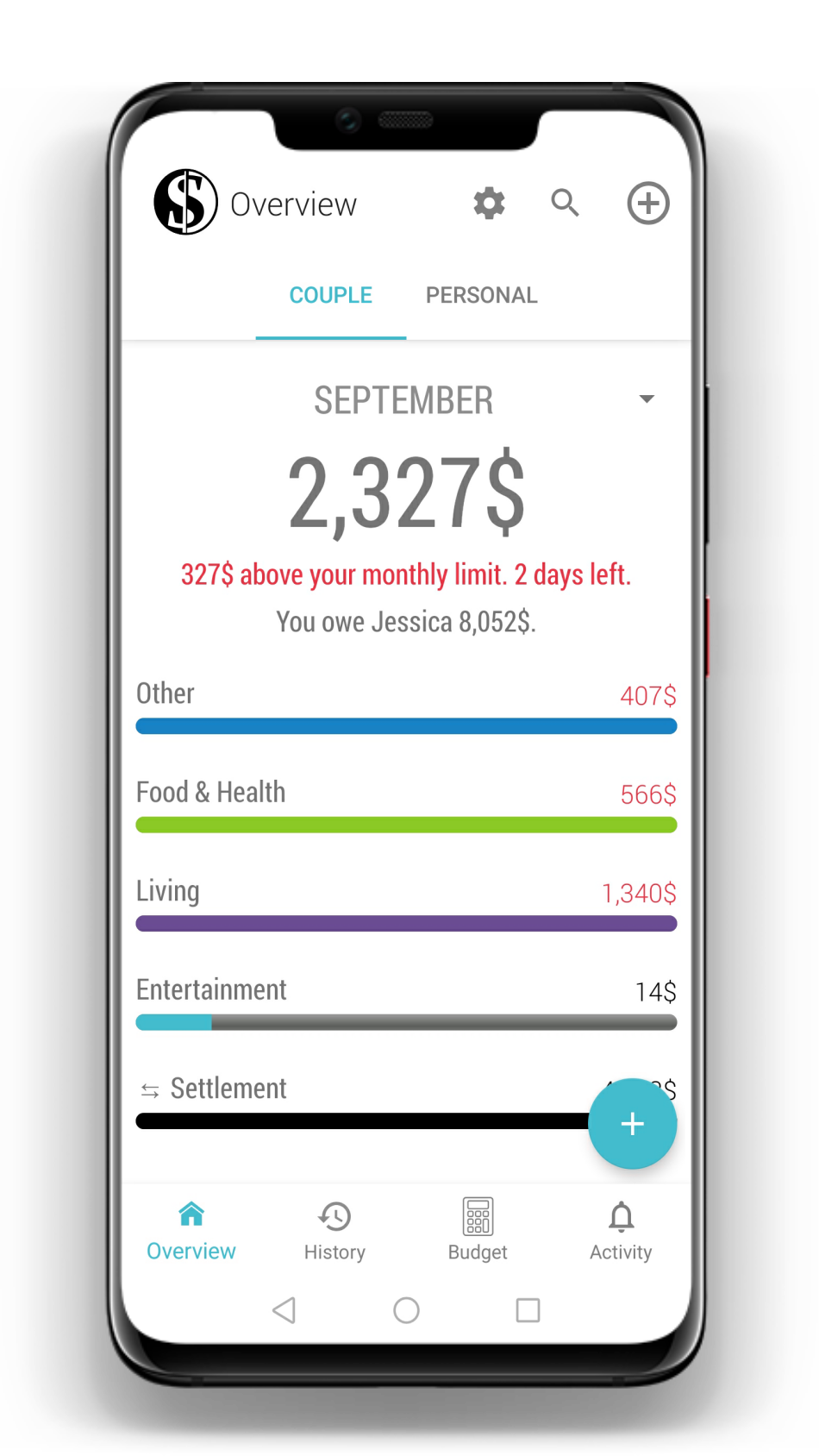

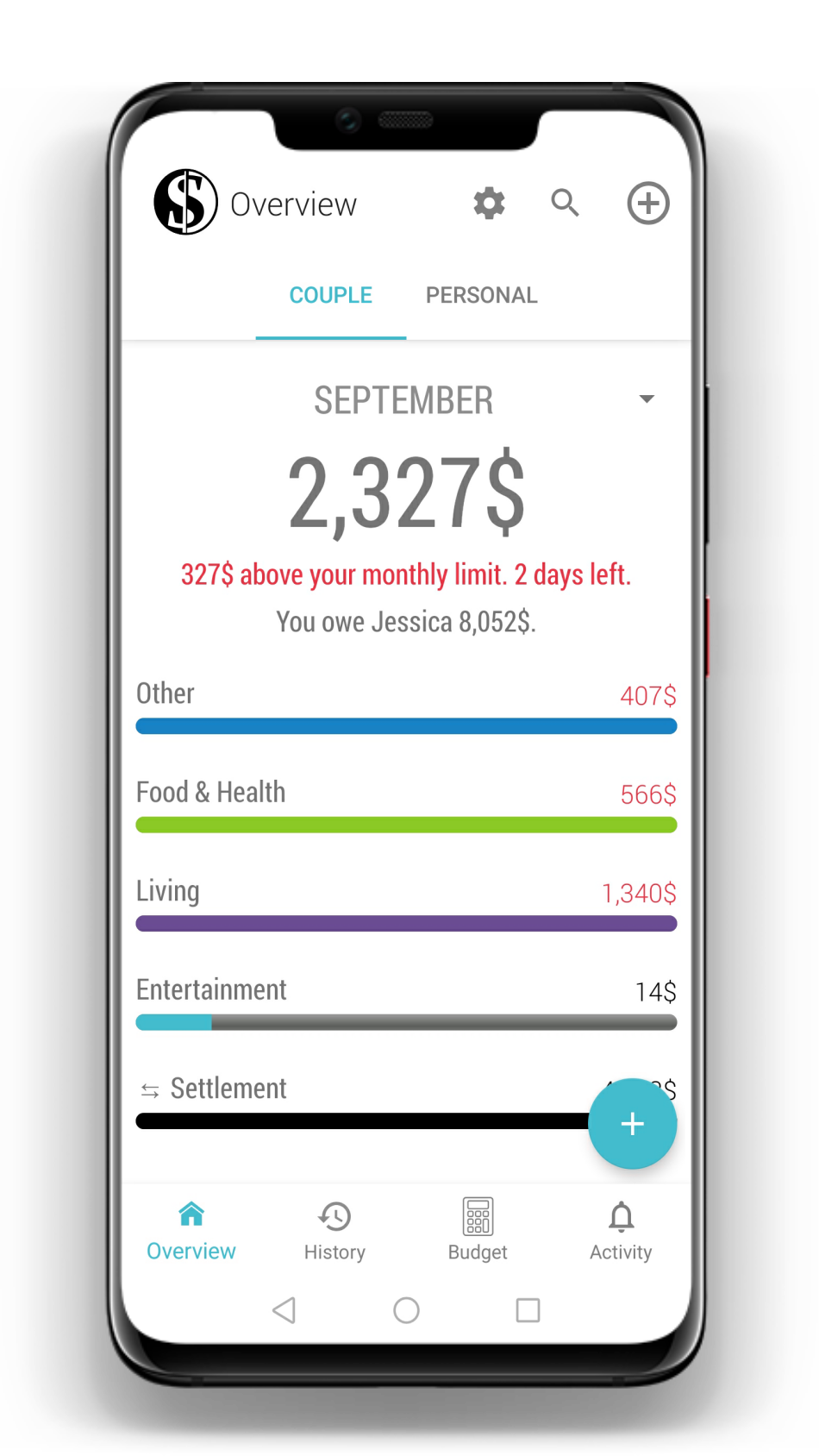

Always know how much you owe to your partner.

Distinguish couple budget from personal ones.

Keep track of budgets that evolve over the years.

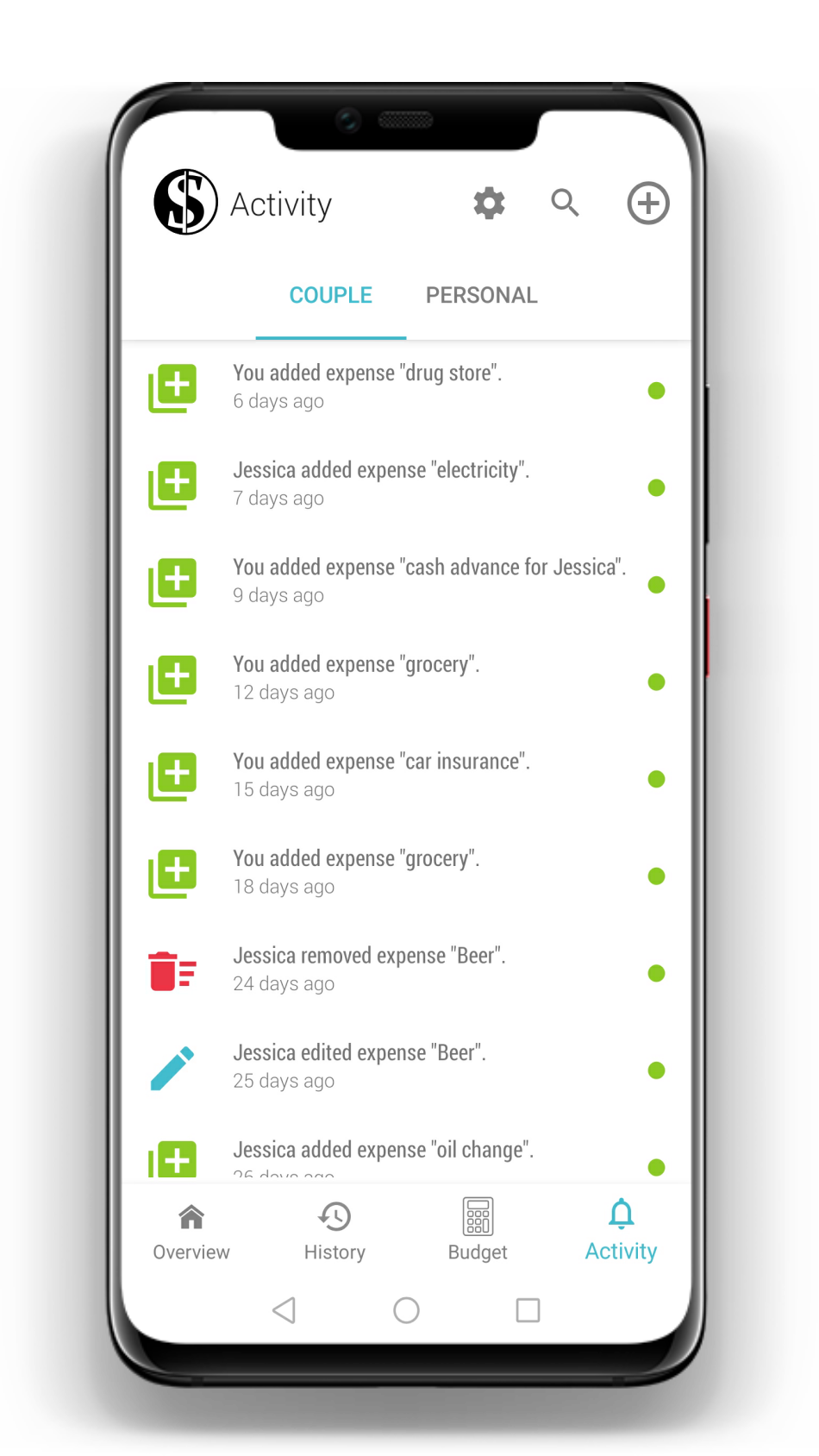

Ensure transparency with indelible activity log.

Settle up with your partner.

Keep your personal budget away from prying eyes.

Benefit from budgets being automatically saved in the Cloud.

Avoid fraud by not having to provide banking information.

Export budgets to spreadsheets.

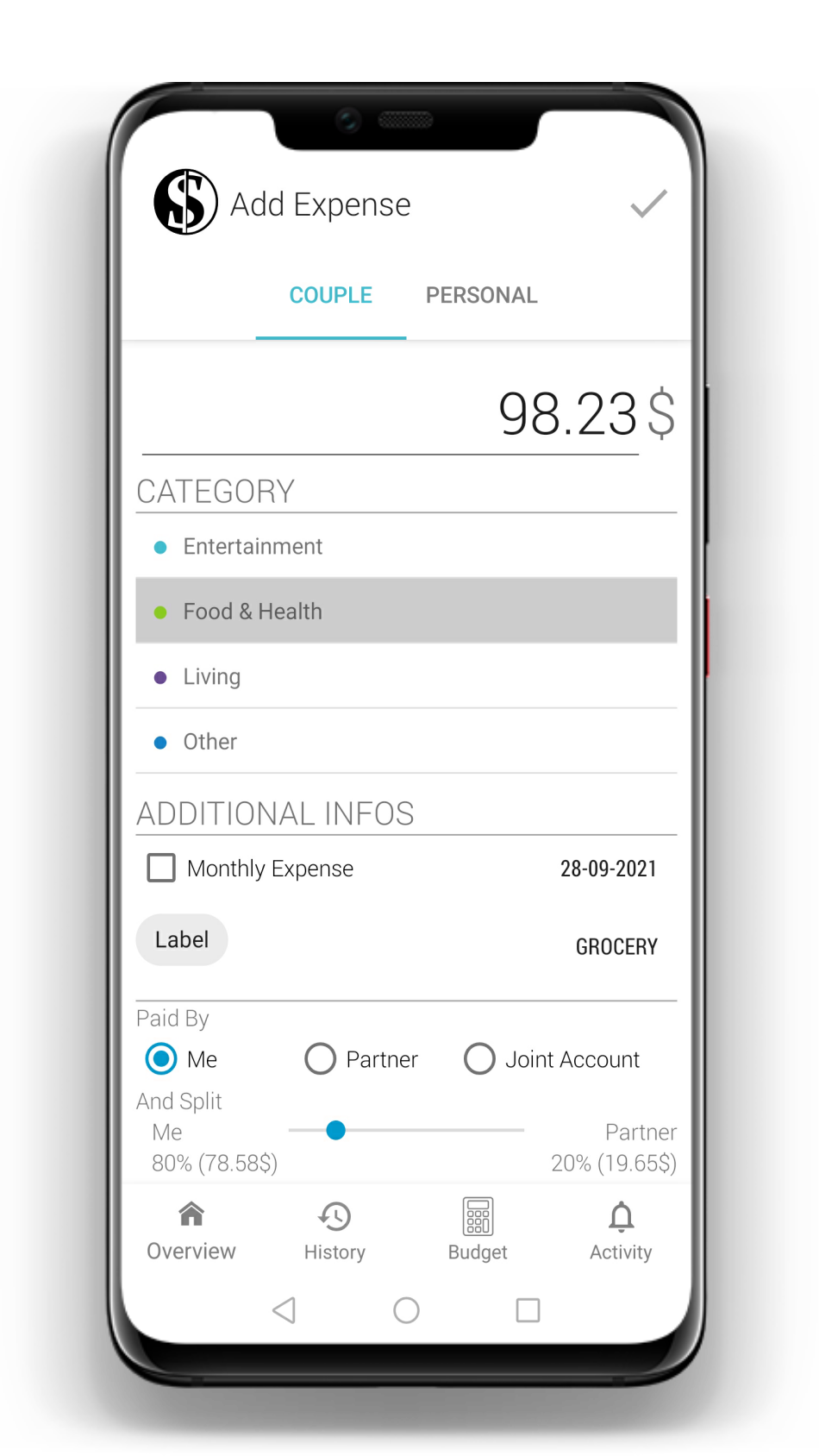

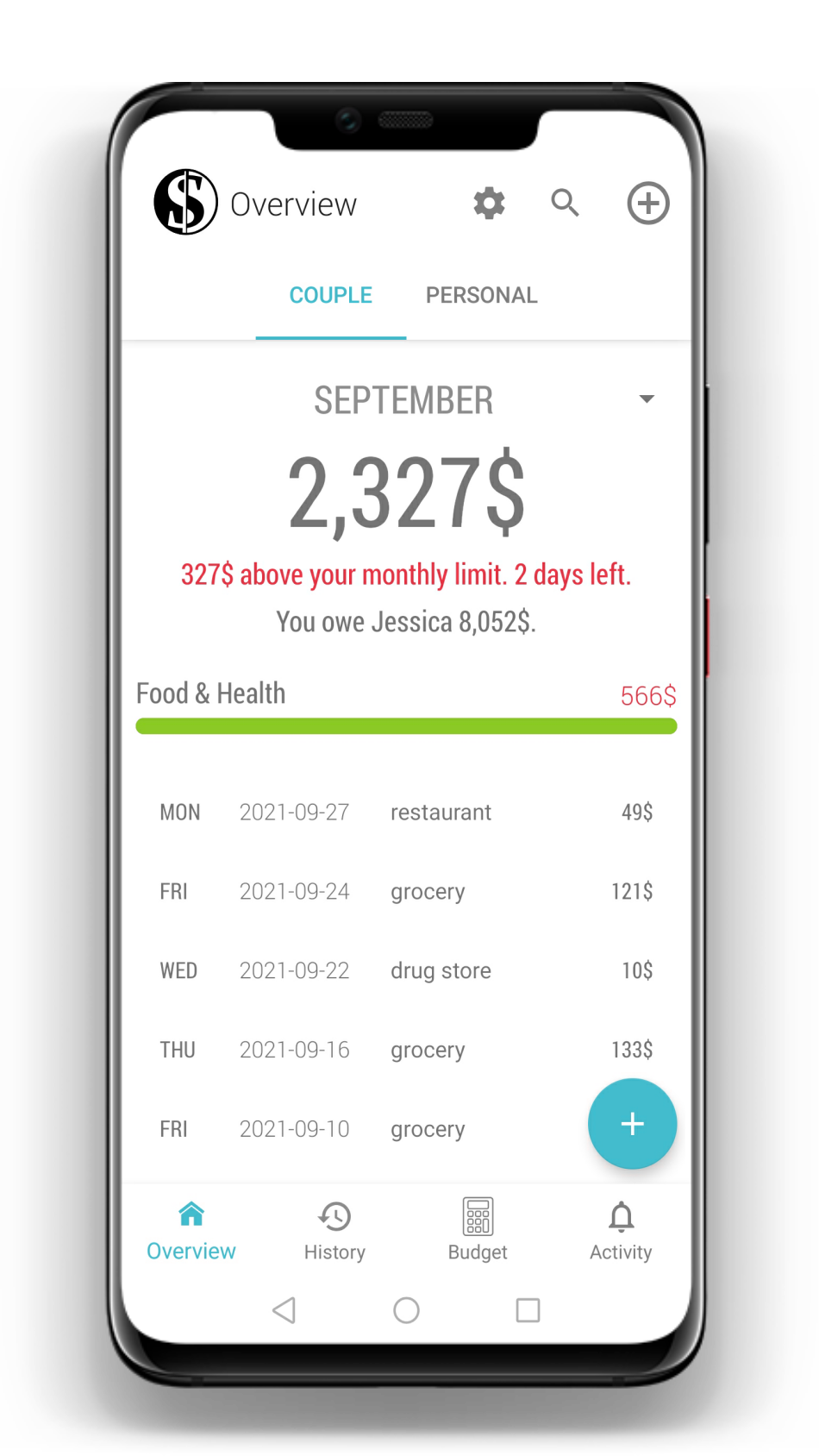

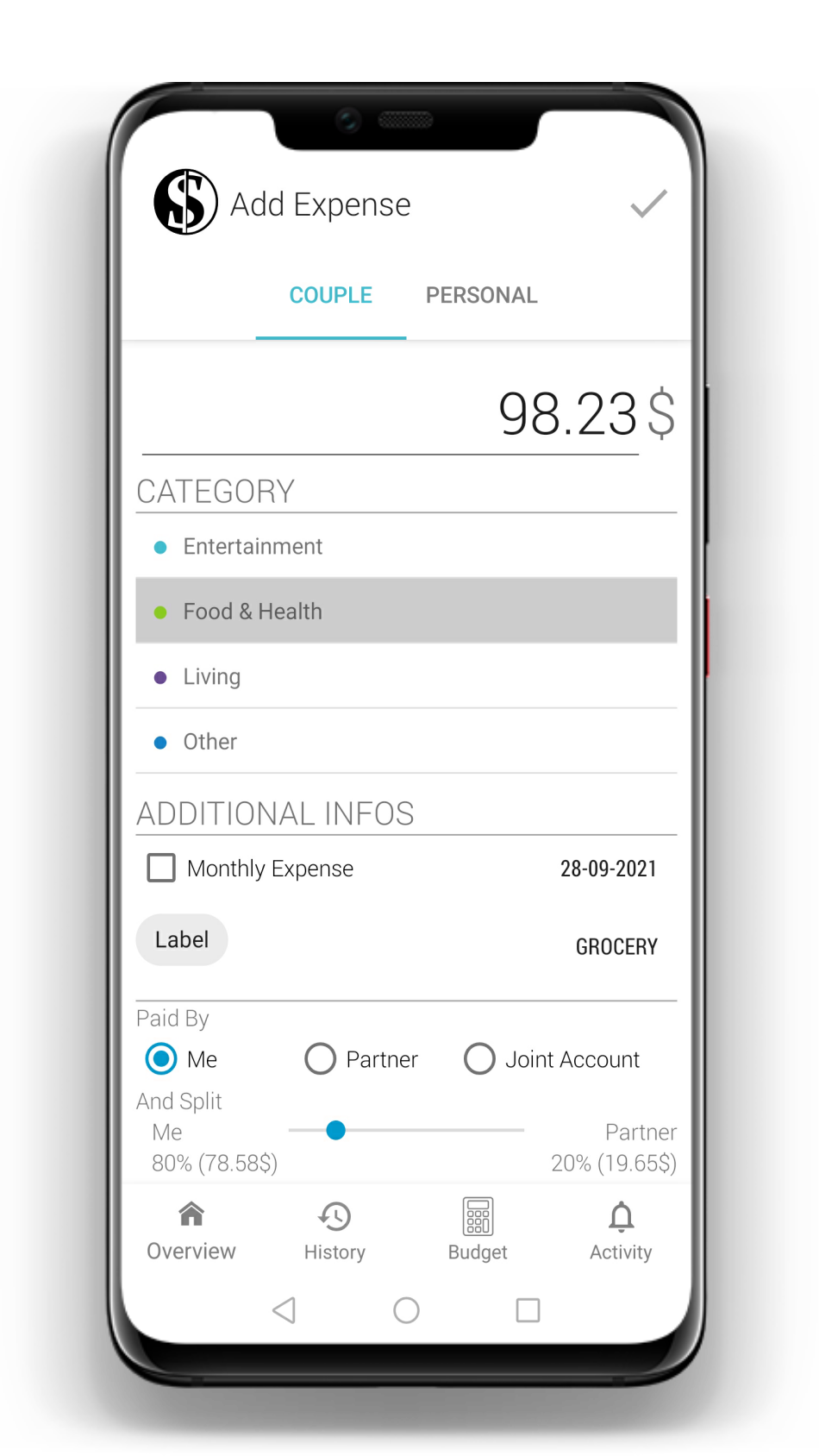

All the benefits of a joint account without their drawbacks. Say hello to Duo Split and easily manage your joint expenses. Either keep an expense in your personal budget or put it in the couple budget by specifying who paid which share. It's your choice to separate expenses according to a proportion, a specific amount or the incomes of the partners. Your personal budget can only be seen by you. In-app reimbursements and auto-accounting is what will make you fall in love with Duo Split.

Try it nowWorriless expense splitting by knowing who paid which share of an expense. No more challenging expense accounting and error prone settlements. At any time you can know how much you owe to your partner. Payment options include joint account for people who simply can't say goodbye to it.

Try it now

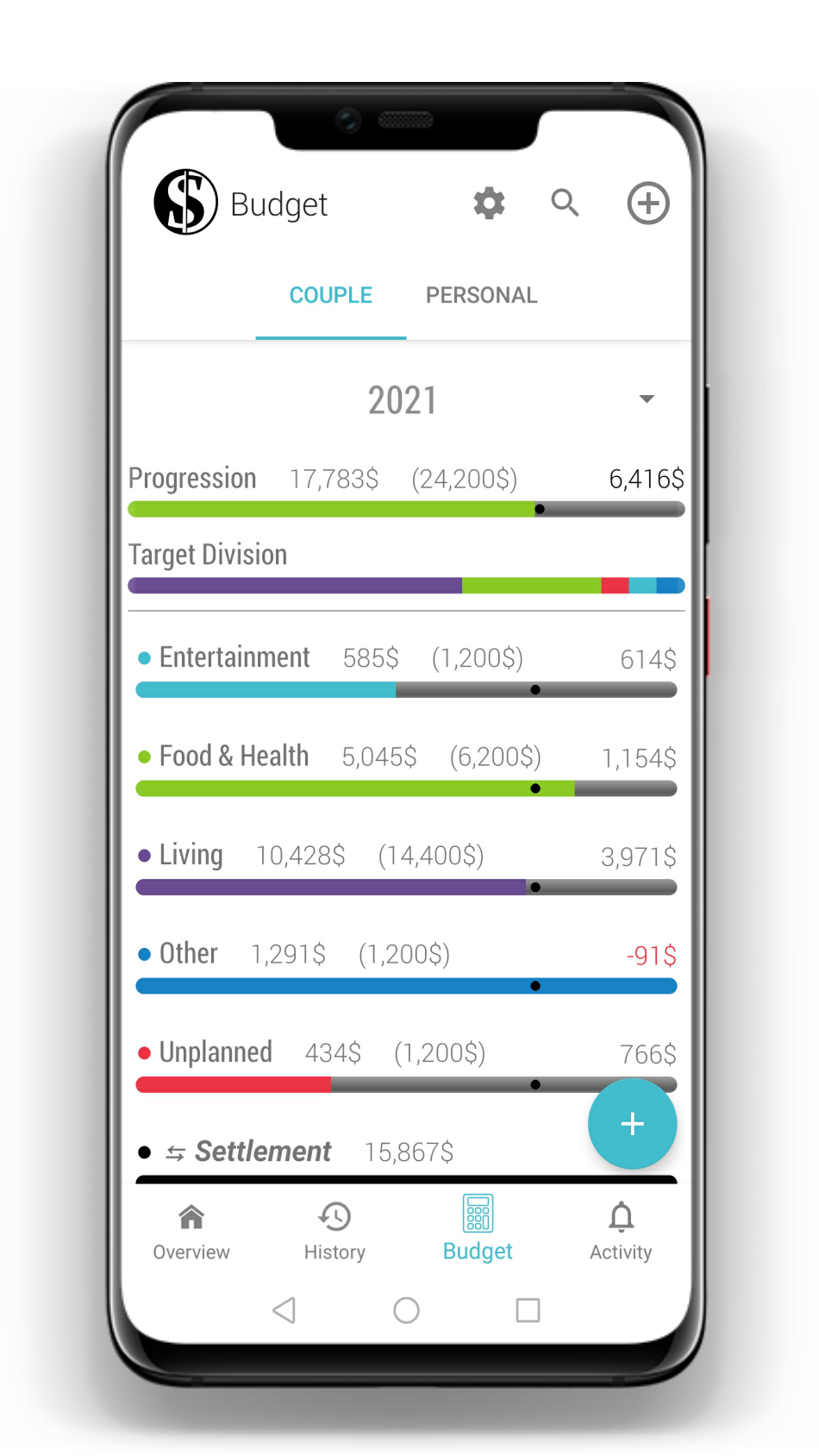

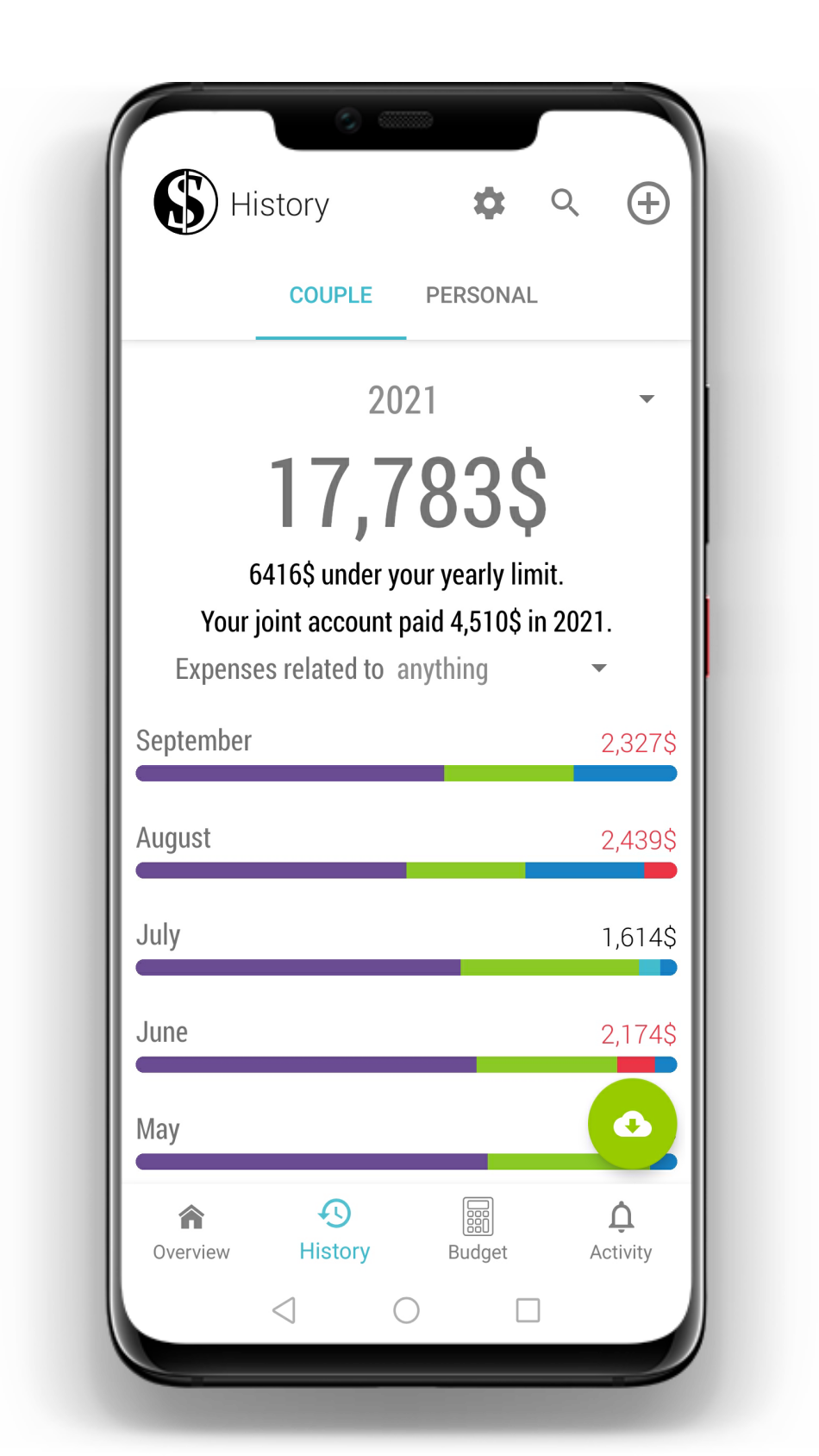

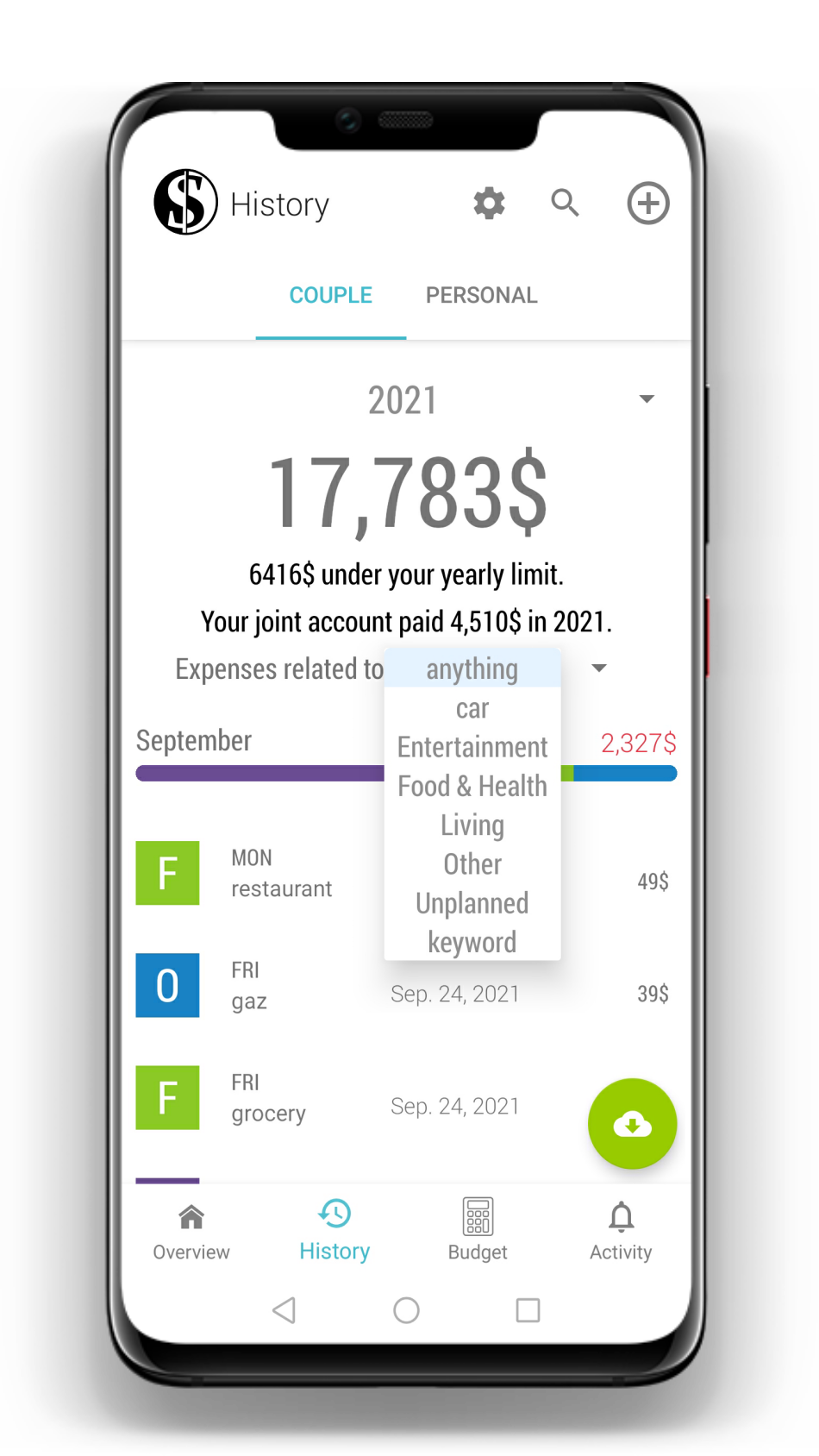

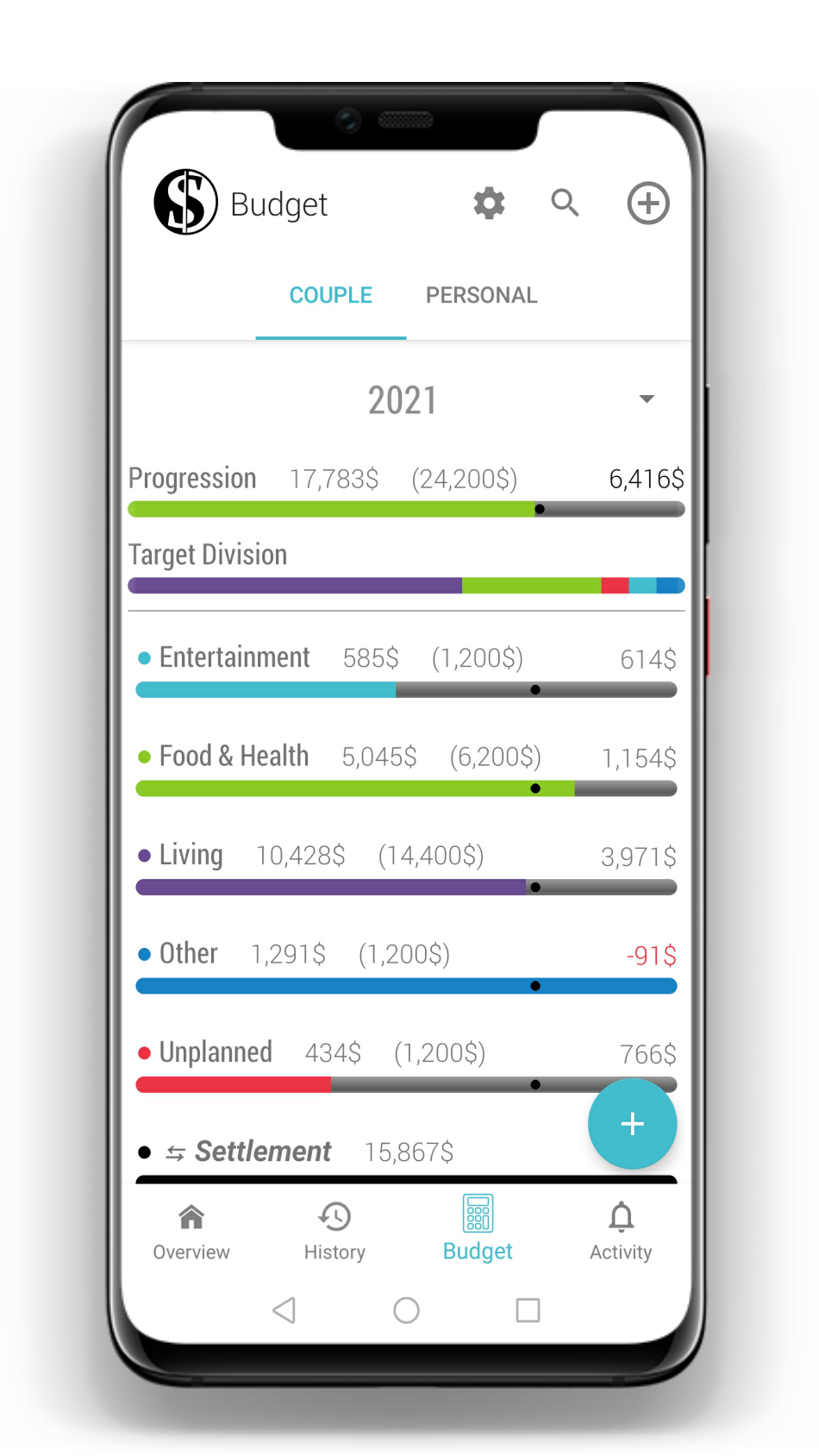

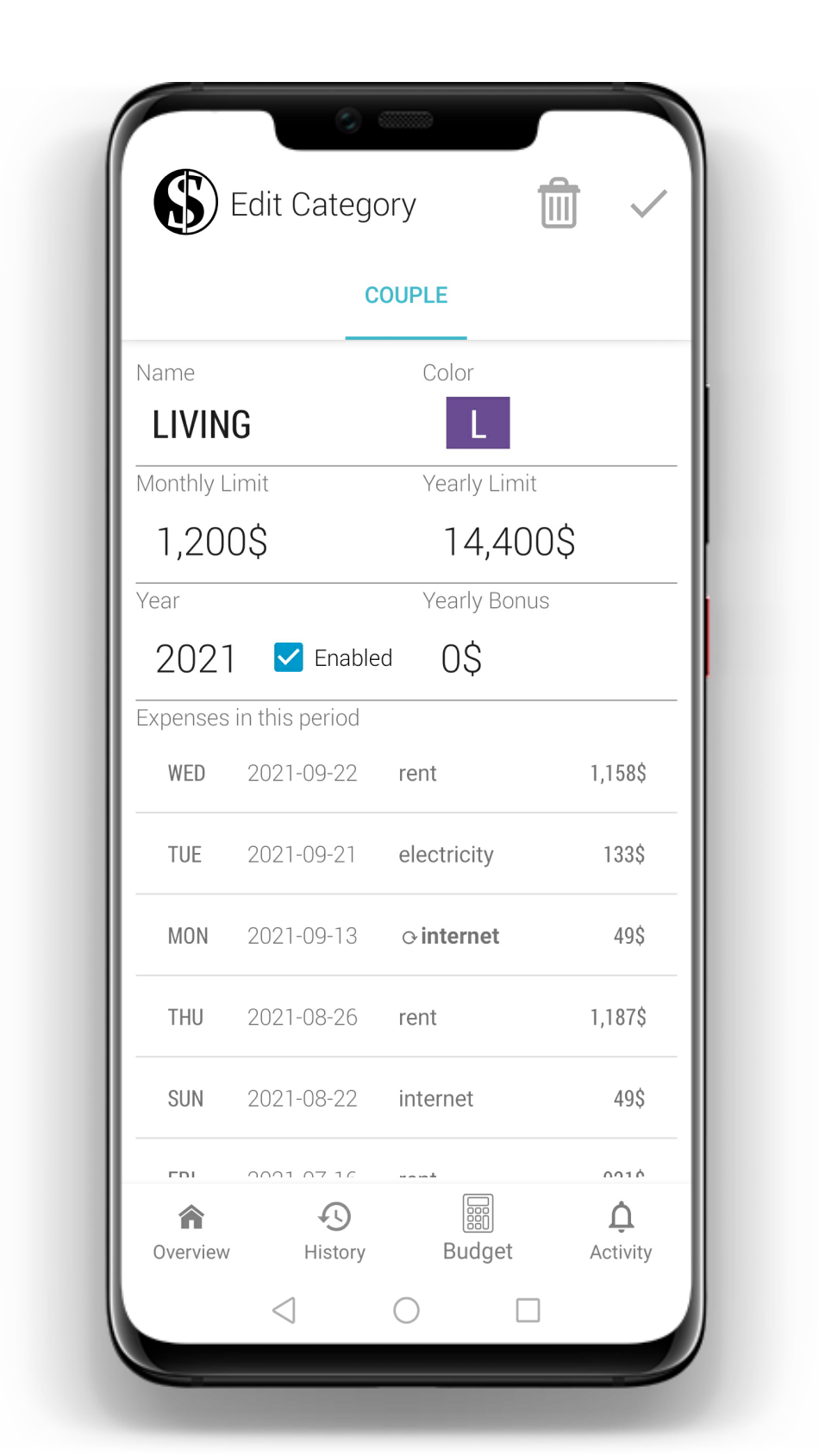

Keeping track of budgets that evolve over the years is crucial to achieve your goals. Duo Split helps you establish annual and monthly budgets. Budget health checks help you know if you are in the right direction, all of this in real time.

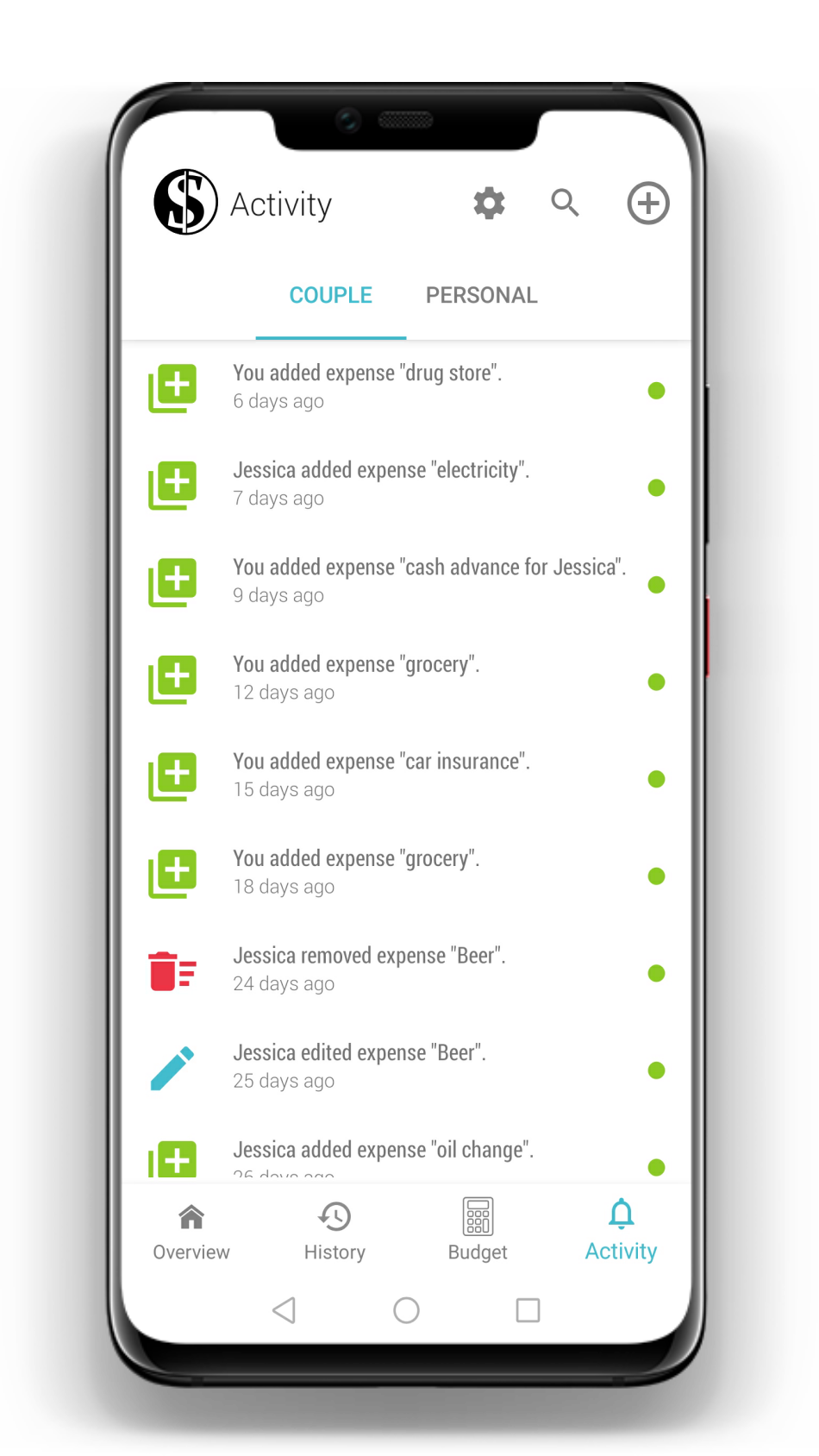

Try it nowTrust is the most important thing in a relationship. Stay tuned of the most recent changes on your budgets. You don't have to worry about your partner modifying the couple budget without your consent.

Try it now

Duo Split is especially for couples who...

... wish to simplify the management of their expenses

... have tried expense aggregation (e.g. Mint) and expense splitter (e.g. Splitwise, Tricount) apps but would like to have the capabilities of these apps in one place

... are bored of maintaining their couples budget and personal ones in two different places

... understand the risks of joint accounts

... recognize the limits of evolution of their budget spreadsheet (e.g. Excel)

People often confuse the joint account with Duo Split. The former is a payment method while the latter is a budget and expense splitting tool. For couples using Duo Split, a joint account adds no benefits since money can be managed through individual bank accounts. People using joint accounts benefit from Duo Split's budget and expense tracking features since this payment method is supported in Duo Split.

Maintaining a couple budget brings concerns and it is in this area that Duo Split stands out. The separation of the couple's expenses and the accounting of the sums due between partners in real time are the elements characterizing Duo Split.

Duo Split is designed for long-term budget commitment of couples. A simple expense splitting app (e.g. Splitwise) is enough for travel expense splitting or to reach other short-term goals.

Yes. Simply add couple expenses through your Duo Split account by specifying who paid.

No. Duo Split exclusively addresses challenges related to expenses.

Yes!

No. There are no banking information saved in Duo Split. There is therefore no risk of identity theft.

Duo Split is not associated with any financial institution or third party. No data is taken from your bank accounts. No data is sold to a third party. Data transmission with Duo Split's Cloud is done via a secure connection similar to the one used by the banks. Rest assured that expenses in your personal budget are only visible to you.

Yes. It is possible to export Duo Split data to a spreadsheet in order to do advanced calculations, visualizations or simply archive your data.

No. Duo Split is an expense and budget tracking app.

Budgets synchronized in Duo Split's cloud are kept indefinitely. At any moment you can ask to delete your data.